Americans who don’t purchase health care insurance will start paying fines in 2014.

The never-ending battle over Obamacare is back in the spotlight as House Republicans push a bill that ties keeping the government operating to defunding the new healthcare law. That's 40+ attempts to kill the program, and this time the nation's credit is at stake. All this comes as public opinion on Obamacare is starting to slip into negative territory. What's the concern? They vary, but some are worried about what happens if you choose not to purchase healthcare - the "tax" part of Obamacare. Today we take a look back at an old fact that delves into the possible penalties.

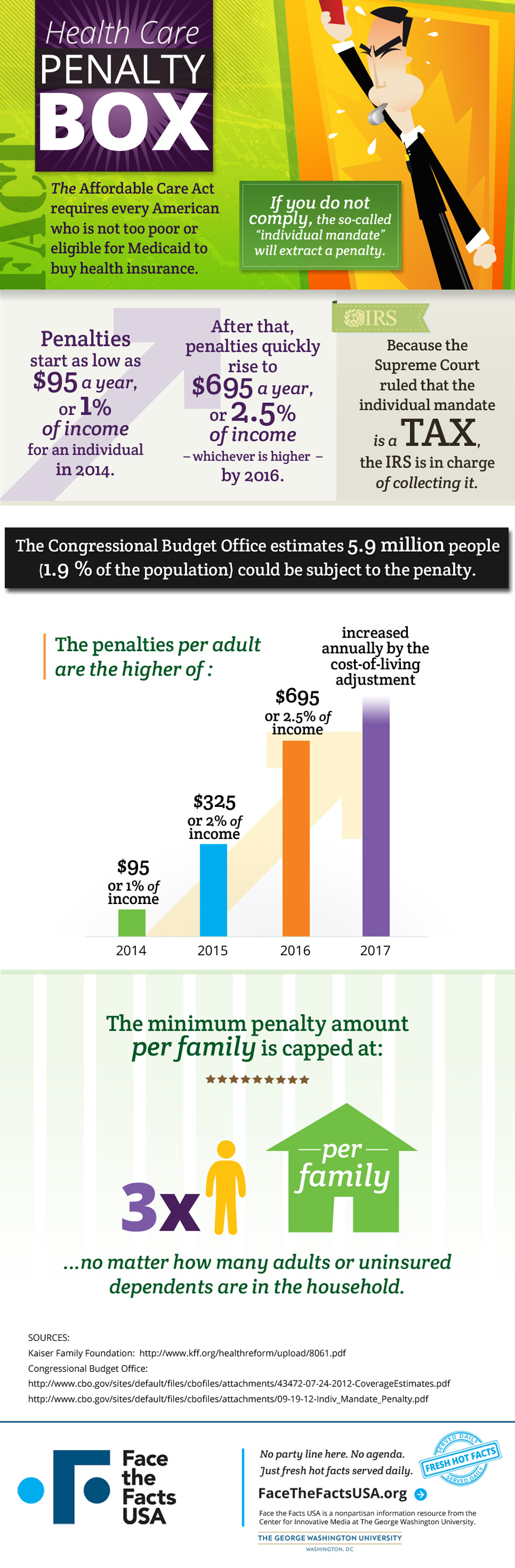

Penalties start in 2014 for those failing to purchase health insurance under the new Affordable Care Act. The fines will start as low as $95 per year for an individual, or 1 percent of a person’s income. By 2016 the individual penalty will rise to $695 or 2.5 percent of income, whichever is higher, unless the individual meets a poverty test or is on Medicaid. This is the “individual mandate” upheld in 2012 by the Supreme Court as a tax, meaning the IRS will collect any penalties.

How many Americans are likely to have to pay up? The Congressional Budget Office has an idea. Find out in today's infographic. Peruse “What Do Others Say?” for a range of views on the coming changes in health coverage. Then join the conversation - how do you feel about the “individual mandate?” What about the upcoming fight in Congress - is this what our representatives should be focusing on?